Minnesota Administrative Rules

CHAPTER 9550, GENERAL ADMINISTRATION OF SOCIAL SERVICES

DEPARTMENT OF HUMAN SERVICES

| Part | Title |

|---|---|

| 9550.0010 | Repealed by subpart |

| 9550.0020 | [Repealed, L 2003 1Sp14 art 11 s 12] |

| 9550.0030 | [Repealed, L 2003 1Sp14 art 11 s 12] |

| 9550.0040 | Repealed by subpart |

| 9550.0050 | Repealed by subpart |

| 9550.0060 | [Repealed, L 2003 1Sp14 art 11 s 12] |

| 9550.0070 | [Repealed, L 2003 1Sp14 art 11 s 12] |

| 9550.0080 | [Repealed, L 2003 1Sp14 art 11 s 12] |

| 9550.0090 | [Repealed, L 2003 1Sp14 art 11 s 12] |

| 9550.0091 | [Repealed, L 2003 1Sp14 art 11 s 12] |

| 9550.0092 | [Repealed, L 2003 1Sp14 art 11 s 12] |

| 9550.0093 | [Repealed, L 2003 1Sp14 art 11 s 12] |

| 9550.0100 | [Repealed, 10 SR 1502] |

| 9550.0200 | [Repealed, 10 SR 1502] |

| TITLE IV-E AND XIX FUNDING ALLOCATION | |

| 9550.0300 | MR 1985 [Repealed, 10 SR 1502] |

| 9550.0300 | PURPOSE. |

| 9550.0310 | DEFINITIONS. |

| 9550.0320 | TITLE IV-E REIMBURSEMENT. |

| 9550.0330 | TITLE XIX REIMBURSEMENT. |

| 9550.0340 | REPORTING REQUIREMENTS. |

| 9550.0350 | DISALLOWANCES. |

| 9550.0360 | HOLD HARMLESS CLAUSE. |

| 9550.0370 | PRIOR PERIOD ADJUSTMENT. |

| 9550.0400 | [Repealed, 10 SR 1502] |

| 9550.0500 | [Repealed, 10 SR 1502] |

| 9550.0600 | [Repealed, 10 SR 1502] |

| 9550.0700 | [Repealed, 10 SR 1502] |

| 9550.0800 | [Repealed, 10 SR 1502] |

| 9550.0900 | [Repealed, 10 SR 1502] |

| 9550.1000 | [Repealed, 10 SR 1502] |

| 9550.1100 | [Repealed, 10 SR 1502] |

| 9550.1200 | [Repealed, 10 SR 1502] |

| 9550.1300 | [Repealed, 10 SR 1502] |

| 9550.1400 | [Repealed, 10 SR 1502] |

| 9550.1500 | [Repealed, 10 SR 1502] |

| 9550.1600 | [Repealed, 10 SR 1502] |

| 9550.1700 | [Repealed, 10 SR 1502] |

| 9550.1800 | [Repealed, 10 SR 1502] |

| 9550.1900 | [Repealed, 10 SR 1502] |

| 9550.2000 | [Repealed, 10 SR 1502] |

| 9550.2100 | [Repealed, 10 SR 1502] |

| 9550.2200 | [Repealed, 10 SR 1502] |

| 9550.2300 | [Repealed, 10 SR 1502] |

| 9550.2400 | [Repealed, 10 SR 1502] |

| 9550.2500 | [Repealed, 10 SR 1502] |

| 9550.2600 | [Repealed, 10 SR 1502] |

| 9550.2700 | [Repealed, 10 SR 1502] |

| 9550.2800 | [Repealed, 10 SR 1502] |

| 9550.2900 | [Repealed, 10 SR 1502] |

| 9550.4100 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.4200 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.4300 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.4400 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.4500 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.4600 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.4700 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.4800 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.4900 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.5000 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| 9550.5100 | [Repealed, L 1985 1Sp14 art 9 s 78 subd 1] |

| PARENTAL FEES FOR CARE OF CHILDREN | |

| 9550.6200 | SCOPE. |

| 9550.6210 | DEFINITIONS. |

| 9550.6220 | DETERMINATION OF PARENTAL FEE. |

| 9550.6225 | HEALTH INSURANCE BENEFITS. |

| 9550.6226 | RESPONSIBILITY OF PARENTS TO COOPERATE. |

| 9550.6228 | REVIEW AND REDETERMINATION OF FEES. |

| 9550.6229 | NOTIFICATION OF CHANGE IN FEE. |

| 9550.6230 | VARIANCE FOR UNDUE HARDSHIP. |

| 9550.6235 | APPEALS. |

| 9550.6240 | COLLECTIONS. |

9550.0010

Published Electronically:

October 15, 2013

9550.0020

[Repealed, L 2003 1Sp14 art 11 s 12]

Published Electronically:

October 15, 2013

9550.0030

[Repealed, L 2003 1Sp14 art 11 s 12]

Published Electronically:

October 15, 2013

9550.0040

Published Electronically:

October 15, 2013

9550.0050

Published Electronically:

October 15, 2013

9550.0060

[Repealed, L 2003 1Sp14 art 11 s 12]

Published Electronically:

October 15, 2013

9550.0070

[Repealed, L 2003 1Sp14 art 11 s 12]

Published Electronically:

October 15, 2013

9550.0080

[Repealed, L 2003 1Sp14 art 11 s 12]

Published Electronically:

October 15, 2013

9550.0090

[Repealed, L 2003 1Sp14 art 11 s 12]

Published Electronically:

October 15, 2013

9550.0091

[Repealed, L 2003 1Sp14 art 11 s 12]

Published Electronically:

October 15, 2013

9550.0092

[Repealed, L 2003 1Sp14 art 11 s 12]

Published Electronically:

October 15, 2013

9550.0093

[Repealed, L 2003 1Sp14 art 11 s 12]

Published Electronically:

October 15, 2013

9550.0100

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.0200

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

TITLE IV-E AND XIX FUNDING ALLOCATION

9550.0300

MR 1985 [Repealed, 10 SR 1502]

9550.0300 PURPOSE.

The purpose of parts 9550.0300 to 9550.0370 is to establish the methods to be used in distributing to local agencies the dollars received by the Department of Human Services from the federal government for administrative and training costs incurred in providing social services under Title IV-E and Title XIX.

History:

12 SR 827

Published Electronically:

October 15, 2013

9550.0310 DEFINITIONS.

Subpart 1.

Scope.

For the purpose of parts 9550.0300 to 9550.0370, the following terms have the meanings given them.

Subp. 2.

Commissioner.

"Commissioner" means the commissioner of the Minnesota Department of Human Services or the commissioner's designated representative.

Subp. 3.

County board.

"County board" means the county board of commissioners in each county. When a human services board or welfare board has been established under Minnesota Statutes, sections 402.02 to 402.10, it shall be considered to be the county board for the purposes of parts 9550.0300 to 9550.0370.

Subp. 5.

Local agency.

"Local agency" means the social services agency authorized by the county board to provide community social services.

Subp. 6.

Social service cost pool.

"Social service cost pool" means all direct and indirect costs incurred by local agencies in providing community social services, except costs that are not allocated through the use of the social service time study.

Subp. 7.

Social service time study.

"Social service time study" means the study conducted by the department that measures the portion of local agency staff time spent on various social service activities for the purpose of determining the percentage of administrative costs attributable to social service expenditures that are federally reimbursable.

Subp. 8.

Substitute care.

"Substitute care" means placement in a group home, family foster home, or other publicly supported out-of-home residential facility, including any out-of-home residential facility under contract with the state, county, other political subdivision, or any of their agencies, to provide those services.

Subp. 9.

Title IV-E.

"Title IV-E" means the federal program that reimburses administrative and training costs incurred in providing services under Public Law 96-272 as amended through June 17, 1980.

Subp. 10.

Title IV-E money.

"Title IV-E money" means the federal dollars claimed and received by the department as reimbursement for administrative and training costs incurred by the local agencies under Title IV-E.

Subp. 11.

Title XIX.

"Title XIX" means the federal program that reimburses the costs incurred in providing health care to eligible persons under United States Code, title 42, sections 1396 to 1396p.

Subp. 12.

Title XIX money.

"Title XIX money" means the federal dollars claimed and received by the department under Title XIX as reimbursement for administrative costs incurred by the local agencies in providing social services to medical assistance program recipients.

History:

12 SR 827; L 2003 1Sp14 art 11 s 11

Published Electronically:

October 15, 2013

9550.0320 TITLE IV-E REIMBURSEMENT.

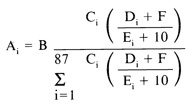

The following equation shall be used to calculate the local agency's share of the Title IV-E money received by the department each quarter of the federal fiscal year:

where:

Ai = the ith local agency's share of Title IV-E money received by the department

B = the total amount of Title IV-E money received by the department to be distributed for the quarter

Ci = the social service cost pool reported by the ith local agency during the quarter

Di = the average monthly number of IV-E eligible children on the ith local agency's caseload for the quarter

Ei = the average monthly number of children in substitute care on the ith local agency's caseload for the quarter

F = a stabilizing factor, equal to the statewide ratio of children eligible under Title IV-E to all children in substitute care, multiplied by ten

History:

12 SR 827

Published Electronically:

October 15, 2013

9550.0330 TITLE XIX REIMBURSEMENT.

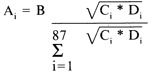

The following equation shall be used to calculate the local agency's share of the Title XIX money received by the department:

where:

Ai = the ith local agency's share of the Title XIX money to be distributed by the department

B = the total amount of Title XIX money received for distribution by the department

Ci = the social service cost pool reported by the ith local agency for the quarter

Di = the average monthly number of persons receiving medical assistance in the ith local agency during the quarter for whom the local agency is financially responsible

History:

12 SR 827

Published Electronically:

October 15, 2013

9550.0340 REPORTING REQUIREMENTS.

Subpart 1.

Information required.

To receive reimbursement under parts 9550.0300 to 9550.0370, the local agency must:

A.

provide the information required by the department to conduct the social service time studies on which the state's federal reimbursement claims for administrative costs under Title IV-E and Title XIX are based; and

B.

submit quarterly reports to the department no later than 20 calendar days after the end of the quarter on forms specified by the commissioner. The quarterly reports must provide the information needed to make the calculations specified in parts 9550.0320 and 9550.0330, including:

(2)

the average monthly number of children in the county who are eligible under Title IV-E during the quarter; and

Subp. 2.

Penalty.

A local agency shall not receive its Title IV-E or Title XIX reimbursement until the agency has provided the information required under subpart 1. If the local agency does not meet the reporting requirements of subpart 1, the commissioner shall send a written notice of noncompliance to the local agency. If a local agency does not comply with subpart 1 within 30 days of the date written notice was sent, the commissioner shall certify a reduction in the local agency's reimbursement by 20 percent for the quarter of noncompliance. Money received or retained by the department as a result of the penalty must be distributed to all local agencies that were not penalized. The percentage of penalty money received by each local agency must be equal to the percentage of Title IV-E money received by the local agency for the quarter.

History:

12 SR 827; L 2003 1Sp14 art 11 s 11

Published Electronically:

October 15, 2013

9550.0350 DISALLOWANCES.

Any disallowances due to audits of federal claims for administrative reimbursement must be shared by all local agencies. A local agency's percentage share of a disallowance must be equal to the percentage of the federal administrative reimbursement received by the local agency for the quarter and program to which the disallowance applies. The commissioner shall notify each county of the action to be taken and the reasons for the action.

History:

12 SR 827

Published Electronically:

October 15, 2013

9550.0360 HOLD HARMLESS CLAUSE.

Subpart 1.

Effect.

For the federal fiscal year 1986, each county shall receive as reimbursement under part 9550.0320 no less than the amount of Title IV-E reimbursement received by the county as of April 1, 1987, for federal fiscal year 1985. The funds needed to satisfy the requirements of this part must be obtained by deducting an equal percentage from the federal fiscal year 1986 Title IV-E allocation to each local agency that did not submit a Title IV-E claim in federal fiscal year 1985.

History:

12 SR 827

Published Electronically:

October 15, 2013

9550.0370 PRIOR PERIOD ADJUSTMENT.

Subpart 1.

Prior adjustments permitted.

A local agency may provide the department with amended reports to correct inaccuracies in data provided for previous quarters. Additional federal revenue obtained as a result of corrections in data for previous quarters must be distributed to all local agencies in accordance with the formulas in parts 9550.0320 and 9550.0330. Any money owed to the federal government because of amended local agency reports under this part must be billed to all local agencies in accordance with the formulas in parts 9550.0320 and 9550.0330.

Subp. 2.

Limitation on prior adjustments.

An amended report must be received by the department no later than 12 months after the reporting deadline for the quarter being amended.

History:

12 SR 827

Published Electronically:

October 15, 2013

9550.0400

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.0500

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.0600

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.0700

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.0800

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.0900

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1000

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1100

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1200

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1300

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1400

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1500

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1600

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1700

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1800

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.1900

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2000

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2100

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2200

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2300

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2400

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2500

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2600

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2700

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2800

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.2900

[Repealed, 10 SR 1502]

Published Electronically:

October 15, 2013

9550.4100

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.4200

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.4300

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.4400

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.4500

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.4600

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.4700

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.4800

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.4900

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.5000

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

9550.5100

[Repealed, L 1985 1Sp14 art 9 s 78 subd 1]

Published Electronically:

October 15, 2013

PARENTAL FEES FOR CARE OF CHILDREN

9550.6200 SCOPE.

Subpart 1.

Applicability.

Parts 9550.6200 to 9550.6240 govern the assessment and collection of parental fees by county boards or the Department of Human Services from parents of children in 24-hour care outside the home, including respite care, in a facility licensed by the commissioner, who:

D.

are in a state facility.

Parts 9550.6200 to 9550.6240 also specify parental responsibility for the cost of services of children who are not specified in items A to D, who are living in or out of their parents' home, and whose eligibility for medical assistance was determined without considering parental resources or income as specified in Minnesota Statutes, section 256B.14, subdivision 2.

Subp. 2.

Exclusion.

Children who are under court order and subject to Minnesota Statutes, section 260B.331, subdivision 1, or 260C.331, subdivision 1, and who also do not fall under the provisions of Minnesota Statutes, section 252.27, are excluded from the scope of parts 9550.6200 to 9550.6240.

Parents of a minor child identified in subpart 1 must contribute monthly to the cost of services unless the child is married or has been married, parental rights have been terminated, or the child's adoption is subsidized according to Minnesota Statutes, section 259.67, or through title IV-E of the Social Security Act, or the parents are determined not to owe a fee under the formula in Minnesota Statutes, section 252.27, subdivision 2a.

History:

10 SR 2005; 16 SR 2780; L 1994 c 631 s 31; L 1999 c 139 art 4 s 2; L 2005 c 56 s 2; 32 SR 565

Published Electronically:

October 15, 2013

9550.6210 DEFINITIONS.

Subpart 1.

Applicability.

As used in parts 9550.6200 to 9550.6240, the following terms have the meanings given them.

Subp. 2.

Child or children.

"Child" or "children" means a person or persons under 18 years of age.

Subp. 3.

Commissioner.

"Commissioner" means the commissioner of the Department of Human Services or the commissioner's designated representative.

Subp. 4.

Cost of services.

"Cost of services" means the cost for:

A.

the per diem rate established by the department or the per diem and negotiated monthly rate adopted by the county board for the 24-hour care outside the home, treatment, and training of a child provided in a facility licensed by the Department of Health, Department of Human Services, or approved by the commissioner according to the interstate placement compacts of Minnesota Statutes, sections 245.51 to 245.53, 260.52 to 260.57, and 260.851 to 260.91; and

Subp. 5.

County board.

"County board" means the county board of commissioners in each county. When a Human Services Board has been established under Minnesota Statutes, sections 402.02 to 402.10, it shall be considered to be the county board for purposes of parts 9550.6200 to 9550.6240.

Subp. 6.

County of financial responsibility.

"County of financial responsibility" has the meaning given it in Minnesota Statutes, section 256G.02, subdivision 4.

Subp. 8.

Emotional disability or emotional disturbance.

"Emotional disability" or "emotional disturbance" has the meaning given it in Minnesota Statutes, section 245.4871, subdivision 15.

Subp. 9.

Income.

"Income" means the adjusted gross income of the natural or adoptive parents determined according to the previous year's federal tax form as specified in Minnesota Statutes, section 252.27, subdivision 2a, paragraph (d), or a verified statement of the adjusted gross income if no tax forms are available.

Subp. 10.

Medical assistance.

"Medical assistance" means the program which provides for the health service needs of eligible clients, as specified in Minnesota Statutes, chapter 256B, and title XIX of the Social Security Act, United States Code, title 42, section 1396.

Subp. 11.

Developmental disability.

"Developmental disability" has the meaning of "developmental disability" under part 9525.0016, subpart 2, and the meaning of "related condition" given in Minnesota Statutes, section 252.27, subdivision 1a.

Subp. 13.

Physical disability.

"Physical disability" has the meaning given it in part 9570.2200, subpart 7.

Subp. 13a.

Respite care.

"Respite care" means short-term supervision and care provided to a child due to temporary absence or need for relief of the child's parents. Respite care may include day, overnight, in-home, or out-of-home services, as needed.

Subp. 15.

Severe emotional disturbance.

"Severe emotional disturbance" means an emotional disturbance that has:

A.

resulted in the child's admission within the last three years or the child's being at risk of admission to inpatient treatment or residential treatment for an emotional disturbance;

B.

required the child to receive inpatient treatment or residential treatment for an emotional disturbance as a Minnesota resident through the interstate compact; or

C.

resulted in a determination by a mental health professional that the child has one of the following conditions:

(3)

psychopathological symptoms as a result of being a victim of physical or sexual abuse or of psychic trauma within the past year; or

(4)

resulted in the child's having significantly impaired home, school, or community functioning that has lasted at least one year or that, in the written opinion of a mental health professional, presents substantial risk of lasting at least one year.

Subp. 16.

State facility.

"State facility" means any facility owned or operated by the state of Minnesota that is under the programmatic direction or fiscal control of the commissioner. State facility includes regional treatment centers; the state nursing homes; state-operated community-based programs; and other facilities owned or operated by the state and under the commissioner's control.

History:

10 SR 2005; 12 SR 102; L 1987 c 403 art 3 s 96; 16 SR 2780; 18 SR 2244; L 1999 c 139 art 4 s 2; L 2005 c 56 s 2

Published Electronically:

August 27, 2015

9550.6220 DETERMINATION OF PARENTAL FEE.

Subpart 1.

Parental responsibility.

The extent to which parents are responsible for reimbursing the county of financial responsibility or the department for the cost of services must be determined according to subparts 2 to 13. Parents have no obligation to contribute assets. The parental responsibility and the role of the agency responsible for collection of the parental fee shall be explained in writing to the parents at the time eligibility for services is being determined. The parental fee shall be retroactive to the first date covered services are received, including any services received in months of retroactive eligibility.

Subp. 2.

Determination of household size.

Natural and adoptive parents and their dependents, as specified in Minnesota Statutes, section 290A.03, subdivision 7, including the child receiving services, shall be counted as members of the household when determining the fee, except that a stepparent shall not be included.

Subp. 3.

Determination of income.

Income must be determined according to Minnesota Statutes, section 252.27, subdivision 2a, paragraph (d).

Subp. 4.

Percentage schedule.

The parental fee shall be computed according to the formula specified in Minnesota Statutes, section 252.27, subdivision 2a, paragraph (b).

Subp. 5.

Annual revision of federal poverty guidelines.

The parental fee shall be revised annually on July 1 to reflect changes in the federal poverty guidelines. The revised guidelines are effective on the first day of July following the publication of changes in the Federal Register.

Subp. 9.

Parental responsibility for clothing or personal needs.

Payment of the parental fee does not exempt the parents from responsibility for the child's clothing and personal needs not included in the cost of services, except as specified in Minnesota Statutes, section 256B.35, subdivision 1.

Subp. 10.

Discharge.

Except as provided in subpart 10a, the full monthly parental fee must be assessed unless services are terminated before the end of a calendar month. In this case, the full fee must be reduced only if the actual cost of services during that month is less than the regular fee.

Subp. 10a.

Parental fee for respite care.

When a child is receiving respite care services, the parental fee must be a per diem fee multiplied by the number of days the child receives respite care. The parental fee for respite care shall be used only when respite care is the single service the child is receiving. When the child is receiving additional services governed by parts 9550.6200 to 9550.6240, the parental fee determined under part 9550.6220 shall apply. The per diem fee must be determined in the following manner:

C.

Using the household size and income figures in items A and B, the percentage schedule in Minnesota Statutes, section 252.27, subdivision 2a, paragraph (b), must be used to determine the applicable percent to be applied to the parents' income.

D.

Determine the per diem fee by multiplying the income from item B by the percent from item C and divide the product by 365.

E.

Any part of a day spent in respite care must be counted as a full day for purposes of this fee.

Subp. 11.

Number of fees.

As specified in Minnesota Statutes, section 252.27, subdivision 2, parents who have more than one child receiving services who meet the criteria identified in part 9550.6200, subpart 1, shall not be required to pay more than the amount for the child with the highest expenditures.

Subp. 12.

Parents not living with each other.

Parents of a minor child who do not live with each other as specified in Minnesota Statutes, section 252.27, subdivision 2a, paragraph (g), shall each pay a fee.

Subp. 13.

Child support payments.

A court-ordered child support payment actually paid on behalf of the child receiving services shall reduce the fee of the parent making the payment.

Subp. 14.

Fees in excess of cost.

The total amount parents must pay between the time the first monthly payment is due under either the initial determination of the fee amount or notice of an increase in the fee amount, and the end of the state's fiscal year in June of each year cannot be higher than the cost of services the child receives during the fiscal year. At the end of each state fiscal year, the department or county board shall review the total amount that the parent paid in fees during the fiscal year and the total cost of services paid by the department or county board, not including payments made to school districts for medical services identified in an individualized education program and covered under the medical assistance state plan, that the child received during the fiscal year. If the total amount of fees paid by the parents exceeds the total cost of services, the department or county board shall: (1) reimburse the parents the excess amount if their child is no longer receiving services; or (2) apply the excess amount to parental fees due starting July 1 of that year, until the excess amount is exhausted.

History:

10 SR 2005; 12 SR 102; 16 SR 2780; 33 SR 1107; L 2011 1Sp11 art 3 s 12

Published Electronically:

October 15, 2013

9550.6225 HEALTH INSURANCE BENEFITS.

The parental fee determined under part 9550.6220 shall be increased by an additional five percent if the department or local agency determines that insurance coverage is available to the parents, but not obtained for the child receiving services. For purposes of this part, "available" and "insurance" have following meanings.

A.

"Available" means the insurance is a benefit of employment for a family member at an annual cost of no more than five percent of the family's annual income.

B.

"Insurance" means health and accident insurance coverage, enrollment in a nonprofit health service plan, health maintenance organization, self-insured plan, or preferred provider organization.

History:

10 SR 2005; 16 SR 2780

Published Electronically:

October 15, 2013

9550.6226 RESPONSIBILITY OF PARENTS TO COOPERATE.

Subpart 1.

Request for information.

The department or county board shall send the parents a form describing:

Subp. 2.

Determination of parental fees.

Parents shall attach to the form requesting financial information, a copy of their previous year's federal income tax return or a verified statement concerning their income if no federal income tax form is available. Failure or refusal by the parents to provide to the department or county board within 30 calendar days after the date the request is postmarked, the financial information needed to determine parental responsibility for a fee shall result in notification to the parents that the department or county board may institute civil action to recover the required reimbursement under Minnesota Statutes, sections 252.27, subdivision 3, and 256B.14, subdivision 2.

Subp. 3.

Review and redetermination of parental fees.

When parents are requesting a review or redetermination of the fee under part 9550.6228, a request for information shall be sent to the parents within ten calendar days after the department or county board receives the parents' request for review. Parents shall:

A.

notify the department or county board within 30 calendar days of a gain in income or a loss of a household member; and

B.

provide to the department or county board all information required under part 9550.6228, subpart 3, to verify the need for redetermination of the fee.

No action shall be taken on a review or redetermination of the parental fee until the required information is received by the department or county board.

Subp. 4.

Variance requests.

No action shall be taken by the department or county board on a request for a variance until the department or county board receives all information required under part 9550.6230. Failure of the parents to cooperate by completing and returning the form requesting parental information to the department or county board within 30 calendar days after the date the request is postmarked, will result in a final written notice to the parents stating that the request for a variance will be denied unless the parents complete and return this information within ten calendar days after the date this final notice is postmarked.

History:

16 SR 2780

Published Electronically:

October 15, 2013

9550.6228 REVIEW AND REDETERMINATION OF FEES.

Subpart 1.

Review.

Parental fees must be reviewed by the county board or the department according to Minnesota Statutes, section 252.27, subdivision 2a, paragraph (f), in any of the following situations:

C.

when the department or county billing records, on the history of service use, indicate a disparity between the fee amount and the cost of services provided of 60 percent or more; or

D.

when there is a loss of or gain in income from one month to another in excess of ten percent.

For self-employed individuals, the following conditions shall apply to the verification of loss or gain of income under item D:

(2)

paystubs, signed statements from employers and contractors, and/or bank statements or verified statements from the parents shall be furnished to support the request for redetermination; and

(3)

the county or department may require other information which is necessary to support the request for redetermination.

Subp. 3.

Procedures for review.

In reviewing the parental fees under this part, the department or county board shall use the following procedures:

A.

The annual review of parental fees under subpart 1, item A, shall be done according to procedures in part 9550.6220, subpart 14.

B.

The review of parental fees under subpart 1, item B, shall be done within ten calendar days after the department or county board receives a copy of the record of birth or other supporting documents as verification of the change in household size.

C.

The review of parental fees under subpart 1, item C, shall consist of a review of historical department or county billing records. Parents whose fee is adjusted under subpart 1, item C, shall sign a written agreement in which the parents agree to report to the department or county board any increase in the amount of services provided and to make up any shortfall at the end of the fiscal year based upon the increase in the amount of services provided.

D.

The review of parental fees under subpart 1, item D, shall be done within ten calendar days after the department or county board receives completed information that verifies a loss or gain in income in excess of ten percent.

History:

10 SR 2005; 16 SR 2780; L 2001 1Sp9 art 15 s 32

Published Electronically:

October 15, 2013

9550.6229 NOTIFICATION OF CHANGE IN FEE.

Subpart 1.

Increase in fee.

Notice of an increase in the parental fee amount shall be mailed by the department or county board to the parents of children currently receiving services, 30 calendar days before the increased fee is effective. An increase in the parental fee is effective in the month in which the decrease in household size or increase in parental income occurs for parents who fail to comply with part 9550.6226, subpart 3.

Subp. 2.

Decrease in fee.

A decrease in the parental fee is effective in the month that the parents verify a reduction in income or a change in household size occurred, retroactive to no earlier than the beginning of the current fiscal year.

History:

10 SR 2005; 16 SR 2780

Published Electronically:

October 15, 2013

9550.6230 VARIANCE FOR UNDUE HARDSHIP.

Subpart 1.

Definition; limitations on variance.

For purposes of this part, "variance" means any modification of the parental fee as determined by Minnesota Statutes, section 252.27, subdivision 2a, when it is determined that strict enforcement of the parental fee would cause undue hardship. All variances shall be granted for a term not to exceed 12 months, unless otherwise determined by the department or county board. The parents' liability to pay under Minnesota Statutes, section 252.27, subdivision 2a, shall be modified only by the provisions in subparts 1a and 2.

Subp. 1a.

Variance for undue hardship.

A variance of the parental fee determined according to Minnesota Statutes, section 252.27, subdivision 2a, and parts 9550.6220 to 9550.6240 may be requested when expenditures for items A through D are made by the parents and the expenditures are not reimbursable by any public or private source. Each expenditure may be the basis for a variance only one time. The total amount of items A, B, C, and D shall be deducted from income as defined in part 9550.6210, subpart 9.

A.

Payments made since the last review of the fee or within the last 12 months for medical expenditures for the child receiving services or for that child's parents and parents' other dependents when the medical expenditures are not covered by medical assistance or health insurance and are a type, irrespective of amount, which would be allowable as a federal tax deduction under the Internal Revenue Code.

B.

Expenditures since the last review of the fee or within the last 12 months for adaptations to the parents' vehicle which are necessary to accommodate the child's medical needs and are a type, irrespective of amount, which would be allowable as a federal tax deduction under the Internal Revenue Code.

C.

Expenditures since the last review of the fee or within the last 12 months for physical adaptations to the child's home which are necessary to accommodate the child's physical, behavioral, or sensory needs and are a type, irrespective of amount, that would be allowable as a deductible medical expense under the Internal Revenue Code. A variance for physical adaptations to the child's home will be granted only for that portion of the adaptation that does not increase the value of the property.

D.

Unexpected, sudden, or unusual expenditures by the parents since the last review or within the past 12 months that are not reimbursed by any type of insurance or civil action and which are a type, irrespective of amount, which would be allowable as a casualty loss deduction under the Internal Revenue Code.

Subp. 2.

Variance for tax status.

A variance shall be granted, in the form of a deduction from income, as defined in part 9550.6210, subpart 9, if the parents can show that, as a result of the parents' peculiar tax status, there is a gross disparity between the amount of income, as defined in part 9550.6210, subpart 9, allocated to the parents and the amount of the cash distributions made to the parents.

B.

A variance shall not be granted in cases where the tax status was created in whole or in part for the purpose of avoiding liability under parts 9550.6200 to 9550.6240.

C.

Income to be deducted under this subpart shall be deducted only if:

(2)

the parents have no authority to alter the amount of cash distributed during a given year, or the method whereby the cash is distributed.

D.

A variance granted under this subpart shall only be made on the recommendation of the department or county board according to subpart 5.

E.

Parents who are granted a variance under this subpart must sign a written agreement in which the parents agree to report any change in the circumstances which gave rise to the tax status variance, such as an increased distribution, a sale, transfer, or any other transaction affecting the parents' ability to pay within 30 days of that change.

Subp. 3.

Exceptions.

The following expenses shall not be considered to constitute undue hardship and shall not reduce the parental fee or income as defined in part 9550.6210, subpart 9:

A.

new home purchases, other than that portion of the cost of a new home that is directly attributable to the physical, behavioral, or sensory needs of the child receiving services and that is a type, irrespective of amount, which would be allowable as a deductible medical expense under the Internal Revenue Code;

C.

clothing and personal expenses, other than expenses allowed in subpart 1a such as specialized clothing needed by the child receiving services due to their disability; or

D.

any expenditures that are usual and typical, other than those which are allowable under subpart 1a.

Subp. 4.

Procedures for requesting a variance.

Parents may request a variance from parts 9550.6200 to 9550.6240 by submitting a written request to the department or county board that states why compliance with parts 9550.6200 to 9550.6240 would cause undue hardship.

The department or county board shall forward to the parents a request for financial information within ten calendar days after receiving a written request for a variance. Parents must provide the department or county board with the requested financial information, including the previous year's tax forms, and verification of any physical adaptations to the home or vehicle, medical expenditures, casualty losses, or peculiar tax status. The information supplied must be sufficient to verify the existence of undue hardship necessitating a variance. Parents must cooperate by completing and returning all information requested by the department or the county board as necessary to determine or review the parental fee. If parents fail to cooperate by providing this required information, part 9550.6226, subpart 4, applies.

Subp. 5.

Department and county authority to grant variances.

A.

The commissioner shall delegate to the county board the authority to grant variances according to parts 9550.6200 to 9550.6240 for children in 24-hour care outside the home, other than a state facility, where only social services funds are expended for the cost of services.

B.

The department shall grant variances according to parts 9550.6200 to 9550.6240 for parents of children who have a developmental disability, a severe emotional disturbance, or a physical disability and who are:

(2)

residing outside the home where medical assistance funds are expended for the costs of services;

(3)

residing outside the home when both medical assistance and social services funds are expended for the cost of services; and

(4)

determined eligible for medical assistance without consideration of parental income or assets.

Subp. 6.

Payment pending determination of variance request.

Those parents requesting a variance from a notice of an increase in the amount of the parental fee shall continue to make monthly payments at the lower amount pending determination of the variance request. Those parents requesting a variance from an initial determination of the parental fee amount shall not be required to make payment pending determination of the variance request. However, these parents may make payments as desired during the determination. If the variance is granted, any payments made pending outcome of the request that result in overpayment, shall be: (1) reimbursed to the parents if the child is no longer receiving services; or (2) applied to the parental fees remaining in the current fiscal year and the remainder of the excess amount applied to the parental fees due starting in the next fiscal year, if the child is still receiving services. If the variance is denied, the parents shall pay to the department or county board:

Subp. 7.

Insurance settlements; settlements in civil actions.

Parents who are granted a variance under subpart 1a, item D, shall sign a written agreement in which the parents agree to report to the department or the county board any changes in circumstances that gave rise to the undue hardship variance, such as subsequent payment by the insurer on a medical or casualty claim or receipt of settlement in a civil action. Failure by the parents to sign this agreement will result in denial of the variance. The variance shall terminate or be adjusted effective on the date of the parents' receipt of any such settlement.

Subp. 8.

Grant or denial of variance.

When the department or county board receives a request for a variance, written notice of a grant or denial of the variance shall be mailed to the parents within 30 calendar days after the department or county board receives the financial information required under subpart 4. A grant will necessitate a written agreement between the parents and the department or county board with regard to the specific terms of the variance. The variance will not become effective until the written agreement is signed by the parents. If the department or the county board denies in whole or in part the parents' request for a variance, the denial notice shall set forth in writing the reasons for the denial that address the specific hardship raised by the parents and of the parents' right to appeal under part 9550.6235.

History:

10 SR 2005; 16 SR 2780; L 2005 c 56 s 2

Published Electronically:

October 15, 2013

9550.6235 APPEALS.

Subpart 1.

Right of appeal.

Parents aggrieved by an action under parts 9550.6200 to 9550.6240 have the right to appeal according to Minnesota Statutes, section 256.045.

Subp. 2.

Appeal process.

Parents may appeal an action under parts 9550.6200 to 9550.6240 by submitting a written request for a hearing to the department within 30 calendar days after the aggrieved action, or within 90 calendar days if an appeals referee finds that the parents have good cause for failing to request a hearing within 30 calendar days. The hearing is governed by Minnesota Statutes, section 256.045.

Subp. 3.

Rights pending hearing.

If parents appeal on or before the effective date of the increase in the parental fee, the parents shall continue to make payments to the department or the county board in the lower amount while the appeal is pending. Parents appealing an initial determination of a parental fee shall not be required to make monthly payments pending an appeal decision. However, parents may continue to make monthly payments as desired during the appeal process. Any payments made that result in an overpayment shall be: (1) reimbursed to the parents if their child is no longer receiving services; or (2) applied to the parental fees remaining in the current fiscal year and the remainder of the excess amount applied to the parental fees due starting in the next fiscal year.

If the department's or county board's determination is affirmed, the parents shall pay to the department or the county board, within 90 calendar days after the date of the order, the total amount due from the effective date of the original notice of determination of the parental fee. The commissioner's order is binding on the parents and the department or county board and shall be implemented subject to Minnesota Statutes, section 256.045, subdivision 7. No additional notice is required to enforce the commissioner's order.

History:

16 SR 2780

Published Electronically:

October 15, 2013

9550.6240 COLLECTIONS.

Subpart 1.

County responsibility.

The county board shall be responsible for the assessment and collection of parental fees for children in 24-hour care outside the home other than state facilities, where only social services funds are expended for the cost of services.

Subp. 2.

Department responsibility.

The department shall be responsible for the assessment and collection of fees for children who have developmental disabilities, a severe emotional disturbance, or a physical disability and who are:

C.

residing outside the home when both medical assistance and social services funds are expended for the costs of services; and

D.

determined eligible for medical assistance without consideration of parental income or assets.

If the parental fee is for reimbursement for the cost of services to both the local agency and medical assistance, the department shall reimburse the local agency for its expenses first and the remainder shall be reimbursed to the medical assistance account.

History:

10 SR 2005; 16 SR 2780; L 2005 c 56 s 2

Published Electronically:

October 15, 2013

Official Publication of the State of Minnesota

Revisor of Statutes