Minnesota Administrative Rules

CHAPTER 8280, UNIFORM COMMERCIAL CODE

SECRETARY OF STATE

| Part | Title |

|---|---|

| REVISED ARTICLE 9 GENERAL PROVISIONS |

|

| 8280.0010 | PURPOSE. |

| 8280.0015 | DEFINITIONS. |

| 8280.0020 | ESTABLISHING DATE AND TIME OF FILING. |

| 8280.0030 | INFORMATION REQUEST DELIVERY. |

| 8280.0040 | FORMS. |

| 8280.0050 | UNDERPAYMENT POLICIES. |

| 8280.0060 | FEES FOR PUBLIC RECORDS SERVICES. |

| ACCEPTANCE AND REFUSAL OF DOCUMENTS | |

| 8280.0070 | DUTY TO FILE. |

| 8280.0080 | GROUNDS FOR REFUSAL OF FINANCING STATEMENT. |

| 8280.0090 | PROCEDURE UPON REFUSAL. |

| 8280.0100 | ACKNOWLEDGMENT. |

| 8280.0110 | FILING OFFICER NOT RESPONSIBLE. |

| 8280.0120 | REFUSAL ERRORS. |

| 8280.0130 | LIABILITY FOR INFORMATION ERRORS. |

| UCC INFORMATION MANAGEMENT SYSTEM | |

| 8280.0150 | PRIMARY DATA ELEMENTS. |

| 8280.0160 | NAMES OF DEBTORS OR SECURED PARTIES WHO ARE INDIVIDUALS. |

| 8280.0170 | NAMES OF DEBTORS OR SECURED PARTIES THAT ARE ORGANIZATIONS. |

| 8280.0180 | ESTATES. |

| 8280.0190 | TRUSTS. |

| 8280.0200 | STATUS OF FINANCING STATEMENT. |

| 8280.0210 | AMENDMENT. |

| 8280.0220 | ASSIGNMENT OF POWERS OF SECURED PARTY. |

| 8280.0230 | CONTINUATION. |

| 8280.0240 | TERMINATION. |

| 8280.0250 | CORRECTION STATEMENT. |

| 8280.0260 | PROCEDURE ON LAPSE. |

| WEB FILING AND INFORMATION REQUEST PROCEDURES | |

| 8280.0270 | DOCUMENT FILING PROCEDURES. |

| 8280.0280 | INFORMATION REQUEST PROCEDURES. |

| FILING AND DATA ENTRY PROCEDURES | |

| 8280.0290 | OPEN DRAWER. |

| 8280.0300 | DOCUMENT INDEXING AND OTHER PROCEDURES BEFORE ARCHIVING OF PAPER-BASED FINANCING STATEMENTS. |

| 8280.0310 | DOCUMENT INDEXING AND OTHER PROCEDURES BEFORE ARCHIVING OF ELECTRONICALLY BASED UCC DOCUMENTS. |

| 8280.0320 | ERRORS OF THE FILING OFFICER. |

| 8280.0330 | ERRORS OTHER THAN FILING OFFICE ERRORS. |

| 8280.0340 | DATA ENTRY OF NAMES; DESIGNATED FIELDS. |

| 8280.0350 | FINANCING STATEMENT ACCEPTED IN ERROR. |

| 8280.0360 | VERIFICATION OF DATA ENTRY. |

| 8280.0370 | DISTINGUISHING DATA. |

| 8280.0380 | GLOBAL FILINGS. |

| 8280.0390 | ARCHIVES; GENERAL. |

| 8280.0400 | ARCHIVES; DATA RETENTION. |

| 8280.0410 | NOTICE OF BANKRUPTCY. |

| INFORMATION REQUESTS AND REPORTS | |

| 8280.0420 | GENERAL REQUIREMENTS. |

| 8280.0430 | INFORMATION REQUESTS. |

| 8280.0440 | RULES APPLIED TO INFORMATION REQUESTS. |

| 8280.0450 | INFORMATION REQUEST RESPONSES. |

| 8280.0460 | OPTIONAL INFORMATION. |

| 8280.0470 | [Repealed, L 2009 c 98 s 36] |

| FEES | |

| 8280.0480 | FEES. |

REVISED ARTICLE 9

GENERAL PROVISIONS

8280.0010 PURPOSE.

Subpart 1.

Title.

This chapter may be referred to as the Revised Article 9 (Year 2000 revision) Rules.

Subp. 2.

Characterization of duties of filing officer.

The duties and responsibilities of the filing officer with respect to the administration of the Uniform Commercial Code are ministerial. In accepting for filing or refusing to file a financing statement pursuant to this chapter, the filing officer does not:

D.

create a presumption that information in the document is correct or incorrect, in whole or in part.

Subp. 3.

Effective date; application.

This chapter is effective with respect to financing statements filed on or after July 1, 2001, and to predecessor filings in effect immediately before that date.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0015 DEFINITIONS.

Subp. 2.

Amendment.

"Amendment" has the meaning given it in Minnesota Statutes, sections 336.9-512 and 336.9-521.

Subp. 3.

Business day.

"Business day" means the 24-hour period from the hour and minute of the event described in the section in which the phrase business day is used to the same hour and minute on the next day on which business is conducted in the office in which the event is occurring. This definition is used in measuring whether certain timelines under Minnesota Statutes, sections 336.9-501 to 336.9-530, and this chapter have been met and does not refer to the hours of operation.

Subp. 4.

Correction statement.

"Correction statement" means a record that indicates under Minnesota Statutes, section 336.9-518, that a financing statement is inaccurate or wrongfully filed.

Subp. 5.

Data.

"Data" means the information contained in a financing statement or supplemental information added by the filing office in association with a financing statement.

Subp. 7.

Electronic transmission.

"Electronic transmission" means any method accepted by the secretary of state for the transmission by electronic format of financing statements, requests for information ("searches"), or associated information.

Subp. 8.

File number.

"File number" means, for a financing statement with an initial financing statement filed on or after July 1, 2001, or which has been converted to digital format on or before that date, a number that includes the year of filing expressed as the first four digits of a unique number assigned to the financing statement by the filing office and a one-digit verification number, to be referred to as a check digit, assigned by the filing office but algorithmically derived from other numbers in the file number. The filing number bears no relation to the time of filing and is not an indicator of priority.

Subp. 9.

Filer.

"Filer" means a person providing information used in a Uniform Commercial Code record or information request.

Subp. 10.

Filing office or filing officer.

"Filing office" or "filing officer" means the office of the secretary of state, except as provided in Minnesota Statutes, section 336.9-501, subsection (a)(1). Satellite offices are agents of the secretary of state, and all rules applicable to the secretary of state apply to satellite offices, except for part 8280.0480 and those portions of other rules in this chapter relating to the form of submission of fees.

Subp. 11.

Financing statement.

"Financing statement" has the meaning in Minnesota Statutes, section 336.9-102, subsection (a)(39). Financing statement shall not be deemed to refer exclusively to paper or paper-based writings. Financing statements may be expressed or transmitted electronically or through media other than paper writings.

Subp. 12.

Global filing.

"Global filing" means a financing statement filed by a secured party for the purpose of amending more than one financing statement, for one or both of the following purposes:

Subp. 13.

Image.

"Image" means the image of a financing statement as stored in the Uniform Commercial Code information management system.

Subp. 14.

Individual.

"Individual" means a human being, or a decedent in the case of a debtor that is the decedent's estate.

Subp. 15.

Initial financing statement.

"Initial financing statement" means a financing statement containing the information required by Minnesota Statutes, section 336.9-502, which, when filed, creates the initial record in the Uniform Commercial Code information management system. A statement filed pursuant to Minnesota Statutes, section 336.9-706, is an initial financing statement and may be filed at any time.

Subp. 16.

Lapse date.

"Lapse date" means the same date of the same month in the fifth year after filing, or in the relevant subsequent fifth anniversary if a timely continuation statement is filed under part 8280.0080, subpart 1, item E, as the original filing date. If the initial financing statement indicates that it is filed with respect to a public finance transaction or a manufactured home transaction, the lapse date is the same date of the same month in the 30th year after filing as the original filing date. The lapse takes effect at midnight at the end of the lapse date. The relevant anniversary for a February 29 filing date is March 1 in the fifth year following the year of the filing date. A lapse date is calculated for each initial financing statement unless the debtor is indicated to be a transmitting utility.

Subp. 17.

Legible.

"Legible" means a communication which may be understood. It is not limited to refer only to written expressions on paper: it requires a machine-readable transmission for electronic transmissions and an otherwise readily decipherable transmission in other cases.

Subp. 18.

Online access.

"Online access" means access to the Uniform Commercial Code information management system and those programs associated with the viewing, searching, and remote filing functions of the Uniform Commercial Code information management system by a remote data connection.

Subp. 20.

Organizational number.

"Organizational number" means the identifying number issued to an entity upon the formation of that entity by the filing office in the jurisdiction of formation.

Subp. 21.

Secured party of record.

"Secured party of record" has the meaning given it in Minnesota Statutes, section 336.9-511, subsection (a).

Subp. 22.

Submitter.

"Submitter" means a person who presents or causes the presentation of a financing statement or information request to the filing officer for filing or response, and includes a service provider who acts as a filer's representative in the filing or information request process but does not include a person responsible merely for the delivery of the document to the filing office, such as the postal service or a courier service.

Subp. 23.

Through date.

"Through date" means the latest date and time for which all records have been entered into the Uniform Commercial Code information management system.

Subp. 24.

UCC.

"UCC" means the Uniform Commercial Code as enacted in this state and in effect from time to time.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0020 ESTABLISHING DATE AND TIME OF FILING.

Subpart 1.

Generally.

The date and time of filing for a financing statement is determined under this part depending on the method of delivery.

Subp. 2.

Personal, courier, or postal delivery.

The time of filing for a financing statement delivered by personal delivery, courier delivery, or postal service delivery at the filing office is the earlier of the time the financing statement is accepted for filing or the next close of office hours following the time of delivery.

Subp. 3.

Electronic delivery.

The time of filing for a financing statement delivered after July 1, 2001, by electronic mail or telecopier delivery to the filing office's electronic mail address or the filing office's fax filing telephone number is, notwithstanding the time of delivery, the earlier of the time the financing statement is accepted for filing or the next close of office hours following the time of delivery.

Subp. 4.

Web page data entry delivery.

Financing statements may, if the service is available, be entered online after July 1, 2002, as described in part 8280.0270. The time of filing of a financing statement delivered by web page data entry is the time that the financing statement has been accepted by the filing office computer system for filing and at which that acceptance is acknowledged by that system and the data is confirmed by the submitter.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

September 10, 2018

8280.0030 INFORMATION REQUEST DELIVERY.

UCC information requests may be delivered to the filing office by any of the means by which financing statements may be delivered to the filing office. Requirements concerning information requests are set forth in part 8280.0430.

UCC information requests on a debtor named on an initial financing statement may be made by an appropriate indication on the face of the initial financing statement form if the relevant fee is also tendered with the initial financing statement.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0040 FORMS.

Subpart 1.

Required forms.

Only the national forms approved by the National Conference of Commissioners on Uniform State Laws or the International Association of Corporation Administrators will be accepted for filing. These forms are reproduced in subparts 2 to 5.

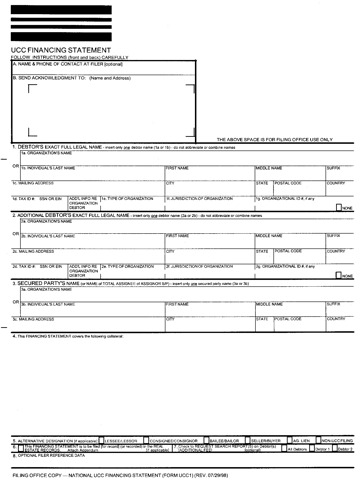

Subp. 2.

UCC Financing Statement.

This subpart contains the Uniform Commercial Code Financing Statement form.

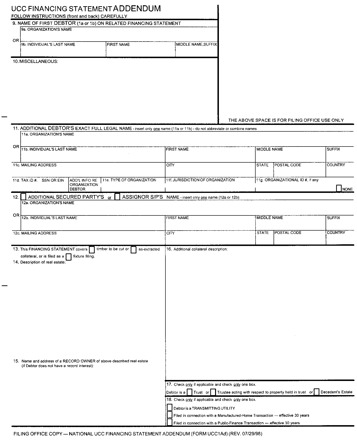

Subp. 3.

UCC Financing Statement Addendum.

This subpart contains the Uniform Commercial Code Financing Statement Addendum form.

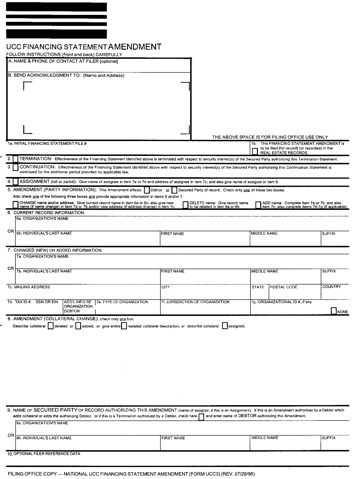

Subp. 4.

UCC Financing Statement Amendment.

This subpart contains the Uniform Commercial Code Financing Statement Amendment form.

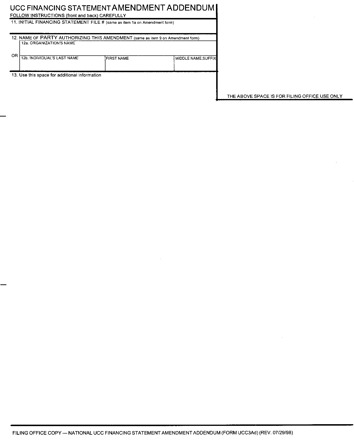

Subp. 5.

UCC Financing Statement Amendment Addendum.

This subpart contains the Uniform Commercial Code Financing Statement Amendment Addendum form.

Subp. 6.

Real property filings.

Any financing statement or record that does not indicate on its face that it is to be filed as a fixture filing in the real property records is filed only as a financing statement and is not filed or recorded in the real property records.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

April 24, 2023

8280.0050 UNDERPAYMENT POLICIES.

On receipt of a document with an insufficient fee, the filing officer must return the financing statement to the submitter as provided in part 8280.0090. If requested, a refund of a partial payment must be included with the document or delivered under separate cover.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0060 FEES FOR PUBLIC RECORDS SERVICES.

The secretary of state will charge fees for providing copies, data, or access as provided in the schedule of fees established by the office of the secretary of state under Minnesota Statutes.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

ACCEPTANCE AND REFUSAL OF DOCUMENTS

8280.0070 DUTY TO FILE.

A financing statement is filed at the time provided in part 8280.0020; provided that there is no ground to refuse acceptance of the financing statement under part 8280.0080.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0080 GROUNDS FOR REFUSAL OF FINANCING STATEMENT.

Subpart 1.

Generally.

The grounds in items A to G are the sole grounds for the filing officer's refusal to accept a financing statement for filing.

A.

A financing statement that adds a debtor must be refused if:

(1)

the document fails to include a legible debtor name and address for a debtor, in the case of an initial financing statement; or

(2)

the document fails to include a legible debtor name and address for the debtor being added in the case of an amendment.

If the document contains more than one debtor name or address and some names and/or addresses are missing or illegible, the filing officer must index the legible name and address pairings, and provide a notice to the submitter containing the file number of the document, identification of the debtor name or names that were indexed, and a statement that debtors with illegible or missing names or addresses were not indexed.

B.

An initial financing statement or an amendment adding one or more debtors must be refused:

(1)

if the document fails to identify whether each named debtor or each added debtor in the case of an amendment is an individual or an organization;

(3)

if, for each debtor identified as an organization, the document does not include in legible form the organization's type, state of organization and organization number, or a statement that it does not have an organization number.

C.

An initial financing statement, an amendment purporting to add a secured party of record, or an assignment must be refused if the document fails to include a legible secured party, or assignee in the case of an assignment, name and address. If the document contains more than one secured party, or assignee, name or address and some names or addresses are missing or illegible, the filing officer must index the legible name and address pairings, and provide notice to the submitter containing the file number of the document, identification of the secured party, or assignee, names that were indexed, and a statement that secured parties with illegible or missing names or addresses were not indexed.

D.

A financing statement other than an initial financing statement must be refused if the document does not provide a file number of a financing statement in the UCC information management system that has not lapsed, or, until June 30, 2006, a number associated with a Uniform Commercial Code filing made in this state before June 30, 2001.

E.

A continuation must be refused if it is not received during the continuation period concluding on the day on which the financing statement would lapse.

(1)

The first day on which a continuation may be filed is the date of the month corresponding to the date on which the financing statement would lapse, six months preceding the month in which the financing statement would lapse. If there is no corresponding date during the sixth month preceding the month in which the financing statement would lapse, the first day on which a continuation may be filed is the last day of the sixth month preceding the month in which the financing statement would lapse, although filing by certain means may not be possible on the date if the filing office is not open on that date.

(2)

The last day on which a continuation may be filed is the date on which the financing statement lapses.

F.

A financing statement must be refused if less than the full filing fee is provided for the document.

G.

Financing statements sent to the filing office by a means of communication not authorized must be refused.

Subp. 2.

Examples of defects that do not constitute grounds for refusal.

The sole grounds for the filing officer's refusal to accept a financing statement for filing are enumerated in subpart 1. The following are examples of defects that do not constitute grounds for refusal to accept a document. They are not a comprehensive enumeration of defects outside the scope of permitted grounds for refusal to accept a financing statement for filing.

A.

The financing statement contains or appears to contain a misspelling or other apparently erroneous information.

B.

(1) The financing statement identifies or appears to identify a debtor incorrectly.

(2)

The financing statement identifies or appears to identify a secured party or a secured party of record incorrectly.

D.

The financing statement contains less than the information required by Article 9 of the UCC, provided that the document contains the information required by subpart 1 to avoid refusal.

E.

The financing statement incorrectly identifies collateral, or contains an illegible or unintelligible description of collateral, or appears to contain no description.

G.

The financing statement does not include a choice of item in box 5, alternative designation, of the National UCC Financing Statement.

K.

The financing statement is both a filing and a search request, and is accompanied by fees sufficient for the filing but not for both the filing and the search request, in which case the filing officer must file the financing statement and request additional fees sufficient to cover the search request.

L.

The financing statement does not include the information requested in box 1d, identification number, of the National UCC Financing Statement or box 7d, identification number, of the National UCC Financing Statement Amendment.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0090 PROCEDURE UPON REFUSAL.

If the filing officer finds grounds under part 8280.0080 to refuse acceptance of a financing statement, the filing officer must return an image of the document to the submitter and must refund the filing fee upon request. The filing office must provide notice containing a brief description of the reason for refusal to accept the document under part 8280.0080. The notice must be provided to a secured party or the submitter as provided in parts 8280.0300, item E, or 8280.0310, item E. A refund may be delivered with the notice or under separate cover. The notice must be provided no later than the second business day after the determination to refuse the document.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0100 ACKNOWLEDGMENT.

At the request of a filer or submitter who files a written financing statement, the filing officer must provide to the filer or submitter an image of the record of the financing statement showing the file number assigned to it and the date and time of filing. For financing statements not filed in written form, the filing officer must communicate to the filer or submitter the information in the financing statement, the file number, and the date and time of filing.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0110 FILING OFFICER NOT RESPONSIBLE.

The responsibility for the legal effectiveness of a financing statement rests with filers and submitters and the filing office bears no responsibility for effectiveness.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0120 REFUSAL ERRORS.

If the filing officer determines that a financing statement that was refused for filing should not have been refused under part 8280.0080, the filing officer will file the financing statement as provided in this chapter reflecting a date and time when filing should have occurred. The filing officer must also record a correction (and such demonstration of error shall constitute the secured party's authorization to the filing officer to do so) that states that the effective date and time of filing are the date and time the financing statement was originally tendered for filing and sets forth that date and time.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0130 LIABILITY FOR INFORMATION ERRORS.

The state, the secretary of state, counties, county recorders, filing officers, filing offices, and their employees and agents are immune from liability that occurs as a result of errors in or omissions from information provided from the UCC information management system.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

UCC INFORMATION MANAGEMENT SYSTEM

8280.0150 PRIMARY DATA ELEMENTS.

The primary data elements used in the UCC information management system are contained in items A to F.

A.

(1) Each initial financing statement is identified by its file number as defined in Minnesota Statutes, section 336.9-102. A file number for the initial financing statement is permanently associated with the record maintained in the UCC information management system. A record is created and maintained in the information management system for each financing statement.

(2)

A financing statement other than an initial financing statement is identified by a unique file number assigned by the filing officer. In the UCC information management system, records of all financing statements other than initial financing statements are linked to the record of the related initial financing statement.

The sequence of the identification number is not an indication of the order in which the document was received.

B.

The type of financing statement from which data is transferred is identified in the UCC information management system from information on the financing statement. The filing date and filing time of financing statements are stored in the UCC information management system.

C.

The names and addresses of debtors and secured parties are entered from financing statements and records into the UCC information management system.

D.

In the UCC information management system, each financing statement has a status of active or inactive. Active financing statements are those that are unlapsed or that have lapsed within one year before the determination of status, except in the case of a financing statement filed against a transmitting utility that remains active until one year after it is terminated with respect to all secured parties of record. All other financing statements are inactive.

E.

The total number of pages in a financing statement is maintained in the UCC information management system.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0160 NAMES OF DEBTORS OR SECURED PARTIES WHO ARE INDIVIDUALS.

When the name of a debtor or a secured party on a financing statement is that of an individual, items A to E apply.

A.

The names of individuals are stored separately from the names of organizations. Separate fields are established for first, middle, and last names (surnames or family names) of individuals. The filing officer assumes no responsibility for the accurate designation of the components of a name but will enter the data according to the filer's designations as required by part 8280.0340.

B.

Titles and prefixes, such as "doctor," "reverend," "Mr.," and "Ms." must not be stored in the UCC information management system.

C.

Titles or indications of status such as "M.D." and "esquire" must not be stored in the UCC information management system.

D.

Suffixes, such as "senior," "junior," "I," "II," and "III" are stored in a field designated for name suffixes.

E.

Personal name fields in the UCC information management system are fixed in length. Although filers should continue to provide full names on financing statements, a name that exceeds the fixed length is stored as presented to the filing officer, up to the maximum length of the field. The lengths of name fields are as follows:

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0170 NAMES OF DEBTORS OR SECURED PARTIES THAT ARE ORGANIZATIONS.

A.

The name of an organization that is a debtor or secured party on a financing statement is stored in a separate field from the names of individuals. A single field is used to store an organization name.

B.

The organization name field in the UCC information management system is fixed in length. The maximum length is 150 characters. Although filers should continue to provide full names on their financing statements, a name that exceeds the fixed length is stored as presented to the filing officer, up to the maximum length of the field.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0180 ESTATES.

Although estates are not natural persons, estate names are stored in the UCC information management system as if the decedent were the debtor under part 8280.0160.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0190 TRUSTS.

If the trust is named in its organic document or documents, its full legal name, as set forth in the organic document or documents, is used. For the purposes of this chapter, trusts are treated as organizations. If the trust is not named, the name of the settlor is used. If a settlor or a trustee is indicated to be an organization, the name is stored as an organization name. If the settlor or trustee is an individual, the name is stored as an individual name.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0200 STATUS OF FINANCING STATEMENT.

On the filing of an initial financing statement, the status of the parties and the status of the financing statement will be as provided in items A to C.

A.

Each secured party named on a financing statement is a secured party of record, except that if the initial financing statement names an assignee, the secured party/assignor is not a secured party of record and the secured party/assignee is a secured party of record.

B.

The status of a debtor named on the financing statement is active and continues as active until one year after the financing statement lapses.

C.

The status of the financing statement is active. A lapse date must be calculated, five years from the filing date, unless the initial financing statement indicates that it is filed with respect to a public financing or manufactured home transaction, in which case the lapse date will be 30 years from the filing date, or if the initial financing statement indicates that it is filed against a transmitting utility, in which case there shall be no lapse date. A financing statement remains active until one year after it lapses, or if it is filed against a transmitting utility, until one year after it is terminated with respect to all secured parties of record.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0210 AMENDMENT.

On the filing of an amendment, the status of the parties and the status of the financing statement will be as provided in items A and B.

A.

An amendment affects the status of its debtor and secured party as follows:

(1)

An amendment that amends only the collateral description or one or more addresses has no effect on the status of any debtor or secured party. If a statement of amendment is authorized by fewer than all of the secured parties or, in the case of an amendment that adds collateral, fewer than all of the debtors, the statement affects only the interests of each authorizing secured party or debtor.

(2)

An amendment that changes a debtor's name has no effect on the status of any debtor or secured party, except that all financing statements that include an identification of an initial financing statement must be cross-indexed in the UCC information management system so that an information request made under either the debtor's old name or the debtor's new name will reveal the related financing statements. The statement of amendment affects only the rights of its authorizing secured party.

(3)

An amendment that changes the name of a secured party has no effect on the status of any debtor or any secured party, but the new name is added to the UCC information management system as if it were the name of a new secured party.

(4)

An amendment that adds a new debtor name has no effect on the status of any party to the financing statement, except the new debtor name must be added as a new debtor in the UCC information management system. The addition will affect only the rights of the secured party or parties authorizing the statement of amendment.

(5)

An amendment that adds a new secured party has no affect on the status of any party to the financing statement, except that the new secured party name must be added as a new secured party in the UCC information management system.

(6)

An amendment that deletes a debtor has no effect on the status of any party in the UCC information management system, even if the amendment claims to delete all debtors.

(7)

An amendment that deletes a secured party of record has no effect on the status of any party in the UCC information management system, even if the amendment claims to delete all secured parties of record.

B.

An amendment has no effect on the status of the financing statement, except that a continuation extends the period of effectiveness of a financing statement.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0220 ASSIGNMENT OF POWERS OF SECURED PARTY.

Subpart 1.

Status of parties.

An assignment has no effect on the status of the parties to the financing statement, except that each assignee named in the assignment becomes a secured party.

Subp. 2.

Status of financing statement.

An assignment has no effect on the status of the financing statement.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0230 CONTINUATION.

Subpart 1.

Term.

On the timely filing of an amendment to continue a financing statement by any secured party of record, the active status of the financing statement must be extended for five years.

Subp. 2.

Status of parties.

The filing of an amendment to continue a financing statement has no effect upon the status of any party to the financing statement.

Subp. 3.

Status of financing statement.

On the filing of an amendment to continue a financing statement, the status of the financing statement remains active.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0240 TERMINATION.

Subpart 1.

Status of parties.

The filing of a termination has no effect on the status of any party to the financing statement.

Subp. 2.

Status of financing statement.

A termination has no effect on the status of the financing statement and the financing statement will remain active in the UCC information management system until one year after it lapses. However, if a termination relates to an initial financing statement that indicates it is filed against a transmitting utility, the financing statement becomes inactive one year after it is terminated with respect to all secured parties of record.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0250 CORRECTION STATEMENT.

Subpart 1.

Status of parties.

The filing of a correction statement has no effect on the status of any party to the financing statement.

Subp. 2.

Status of financing statement.

A correction statement has no effect upon the status of the financing statement.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0260 PROCEDURE ON LAPSE.

If an amendment to continue a financing statement is not timely filed under part 8280.0080, subpart 1, item E, a financing statement lapses on its lapse date but no action is taken by the filing officer at that time. On the first anniversary of the lapse date, the UCC information management system must change the financing statement's status to inactive and it must not be available to a person making an information request unless inactive financing statements are requested and are still available in the UCC information management system.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

WEB FILING AND INFORMATION REQUEST PROCEDURES

8280.0270 DOCUMENT FILING PROCEDURES.

Subpart 1.

Website entry of information.

The secretary of state may, starting July 1, 2002, provide on the Office of the Secretary of State website computer entry screens that allow the entry of information permitted on the national forms.

Subp. 2.

Website fee payments.

The secretary must also provide on the website a method allowing for the payment of the applicable fees for the filing of the financing statement.

Subp. 3.

Website document.

A document that is created by the filer or submitter in this part is filed pursuant to part 8280.0020, subpart 4, and is subject to this chapter as if it were a paper document submitted to the filing office.

Subp. 4.

Filing not accepted notice.

If the filer or submitter does not provide information and the absence of that information or the failure to tender the proper filing fee results in the occurrence of one of the grounds for refusal under part 8280.0080, subpart 1, a message indicating that the filing was not accepted and stating the reason for refusal must appear on the web page from which the filer or submitter is attempting to file, pursuant to part 8280.0310, item E.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

September 10, 2018

8280.0280 INFORMATION REQUEST PROCEDURES.

Starting July 1, 2002, the secretary of state may provide computer entry screens on the Office of the Secretary of State website that allow the entry of information required for a valid information request under part 8280.0430. The secretary may also provide on the website a method allowing for the payment of the applicable fees for the information request. An information request that is created in this manner is subject to this chapter as if it were submitted to the filing office on paper. If the filer or submitter does not provide information and the absence of that information or the failure to tender the proper filing fee results in the inability to fulfill the information request under part 8280.0430, a message indicating that the information request cannot be fulfilled must appear on the web page transmitted to the device from which the filer or submitter is attempting to make the request. Information request response output must appear on the screen of the filer or submitter and must be available to be printed from or downloaded to the device from which the filer or submitter has transmitted the information request, except that computerized filing system subscribers may print and download this information before that date.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

September 10, 2018

FILING AND DATA ENTRY PROCEDURES

8280.0290 OPEN DRAWER.

Except as provided in this part, data are entered from financing statements documents into the information management system exactly as set forth in the document. Personnel or programs creating reports in response to information requests apply information request criteria to the name exactly as set forth on the information request. No effort is made by the filing office to detect or correct errors of any kind.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0300 DOCUMENT INDEXING AND OTHER PROCEDURES BEFORE ARCHIVING OF PAPER-BASED FINANCING STATEMENTS.

A.

Paper-based financing statement processing requires that the transactions necessary for payment of the filing fee are performed.

B.

Paper-based financing statement processing requires that the financing statement is scanned into the UCC information management system.

C.

Paper-based financing statement processing requires that the filing office reviews the image and determines whether a ground exists to refuse the document under part 8280.0080 and Minnesota Statutes, section 336.9-516, subsection (b).

D.

Paper-based financing statement processing requires that if there is no ground for refusal of the financing statement, the file number, filing date, and filing time are permanently associated with the financing statement. File numbers are assigned according to part 8280.0150 and filing date and filing time are assigned according to part 8280.0020. Financing statements are also associated in the UCC information management system pursuant to Minnesota Statutes, section 336.9-519, subsection (f).

E.

Paper-based financing statement processing requires that if there is:

(1)

a ground for refusal of the financing statement, a rejection notice is prepared as provided in part 8280.0090;

(2)

no ground for refusal of the document, an acknowledgment is prepared as provided in part 8280.0100 and Minnesota Statutes, section 336.9-523.

If the financing statement was tendered in person, notice of refusal or acknowledgment of the filing is given by delivering the notice or acknowledgment to the person tendering the filing. Acknowledgment of filing or notice of refusal of a financing statement tendered by means other than personal delivery is provided upon request to the person so requesting.

F.

Paper-based financing statement processing requires that the date and time of receipt are noted on the document or otherwise permanently associated with the record maintained for a financing statement in the UCC information management system at the earliest possible time.

G.

Paper-based financing statement processing requires that data entry and indexing functions are performed as described in this chapter.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0310 DOCUMENT INDEXING AND OTHER PROCEDURES BEFORE ARCHIVING OF ELECTRONICALLY BASED UCC DOCUMENTS.

A.

Electronically based financing statement processing requires that the financing statement, however transmitted, is received in the UCC information management system.

B.

Electronically based financing statement processing requires that:

(1)

for non-web electronic filings, the filing office reviews the image and determines whether a ground exists to refuse the document under part 8280.0080 and Minnesota Statutes, section 336.9-516, subsection (b);

(2)

for electronic filings made on the Office of the Secretary of State website that have passed edit checks in the web program ensuring that data has been provided for each of the required categories for that filing and for which data have been confirmed by the filer or submitter, filing office staff review of the filing is not required.

C.

Electronically based financing statement processing requires that if there is no ground for refusal of the financing statement, the file number, filing date, and filing time are permanently associated with the financing statement. File numbers are assigned according to part 8280.0150 and filing date and filing time are assigned according to part 8280.0020. Financing statements are also associated in the UCC information management system according to Minnesota Statutes, section 336.9-519, subsection (f).

D.

Electronically based financing statement processing requires that if there is no ground for refusal of the document, an acknowledgment is prepared as provided in part 8280.0100. Acknowledgment of filing of a financing statement tendered by electronic means is sent to the electronic address from which the financing statement was received.

E.

Electronically based financing statement processing requires that if there is a ground for refusal of the UCC document, a rejection notice is prepared according to part 8280.0090. Notice of refusal of a UCC document tendered by electronic means is sent to the electronic address from which the financing statement was received.

F.

Electronically based financing statement processing requires that the transactions necessary for payment of the filing fee are performed.

G.

Electronically based financing statement processing requires that the date and time of receipt are noted on the document or otherwise permanently associated with the record maintained for a financing statement in the UCC information management system according to part 8280.0020.

H.

Electronically based financing statement processing requires that data entry and indexing functions are performed as described in this chapter.

If the financing statement was tendered by online access, the notice or acknowledgment is transmitted to the filer or submitter by online response.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

September 10, 2018

8280.0320 ERRORS OF THE FILING OFFICER.

The filing office may correct the errors of filing office personnel in the UCC information management system at any time. If the correction is made after the filing office has issued a through date that includes the filing date of a corrected document, the filing office must make an entry on the record of the financing statement in the UCC information management system stating the date of the correction and explaining the nature of the corrective action taken. The notation must be preserved so long as the record is preserved in the UCC information management system.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0330 ERRORS OTHER THAN FILING OFFICE ERRORS.

An error by a filer is the responsibility of the filer. It can be corrected by filing an amendment, articles of correction under Minnesota Statutes, section 5.16, or it can be disclosed by a correction statement under Minnesota Statutes, section 336.9-518.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0340 DATA ENTRY OF NAMES; DESIGNATED FIELDS.

A filing must designate whether a name is the name of an individual or an organization and, if an individual, must also designate the first, middle, and last names and any suffix. Items A to C apply to the data entry of names.

A.

Organization names are entered into the UCC information management system exactly as set forth in the financing statement, even if it appears that multiple names are set forth in the financing statement or if it appears that the name of an individual has been included in the field designated for an organization name.

B.

Individual names are entered by the filing officer into the first, middle, and last name and suffix fields in the UCC information management system exactly as set forth on the financing statement.

C.

The filing office requires the use of the forms specified in Minnesota Statutes, section 336.9-521, which designate separate fields for individual and organization names and separate fields for first, middle, and last names and any suffix. All documents submitted through website entry are required to use designated name fields.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

September 10, 2018

8280.0350 FINANCING STATEMENT ACCEPTED IN ERROR.

A financing statement that is an initial financing statement or an amendment that adds a debtor to a financing statement and that fails to specify whether the debtor is an individual or an organization should be refused by the filing office. Items A to D apply to a financing statement accepted for filing in error:

A.

When not set forth in a field designated for individual names, a name is treated as an organization name if it contains words or abbreviations that indicate status such as the following and similar words or abbreviations in foreign languages: association, church, college, company, co., corp., corporation, inc., limited, ltd., club, foundation, fund, L.L.C., limited liability company, institute, society, union, syndicate, GmBH, S.A.deC.V., limited partnership, L.P., limited liability partnership, L.L.P., trust, business trust, co-op, cooperative, and other designations established by statutes to indicate a statutory organization. In cases where organization or individual status is not designated by the filer and is not clear, the filing officer shall enter the name in the organization field.

B.

A name is entered as the name of an individual and not the name of an organization when the name is followed by a title substantially similar to one of the following titles, or the equivalent of one of the following titles in a foreign language: proprietor, sole proprietor, proprietorship, sole proprietorship, partner, general partner, president, vice-president, secretary, treasurer, M.D., O.D., D.D.S., attorney at law, Esq., accountant, or CPA. In such cases, the title is not entered.

C.

Where it is apparent that the name of an individual and the name of an entity are stated on a single line and not in a designated individual name field, the name of the individual and the name of the entity must be entered as two separate debtors, one as an individual and one as an entity.

D.

If a filing that fails to designate the last name of an individual debtor in an initial financing statement or an amendment adding the debtor to a financing statement is accepted in error, or if only the last name is designated, the following data entry rules apply:

(1)

an initial in the first position of the name is treated as a first name and an initial in the second position of the name is treated as a middle name;

(2)

an initial and a name to which the initial apparently corresponds is entered into one name field only;

(5)

a nickname is entered in the name field together with the name preceding the nickname, or if none, then as the first name.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0360 VERIFICATION OF DATA ENTRY.

To verify the accuracy of data entry tasks, double-key entry is employed for data entered in the following fields:

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0370 DISTINGUISHING DATA.

The filer of a financing statement that uses a settlor's name must provide other information to distinguish the debtor trust from other trusts having the same settlor and all financing statements filed against trusts or trustees acting with respect to property held in trust must indicate the nature of the debtor. If this is done in, or as part of, the name of the debtor, it will be entered as if it were a part of the name under parts 8280.0340 and 8280.0350.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0380 GLOBAL FILINGS.

Subpart 1.

Acceptance.

The filing officer shall accept for filing global filings as defined in part 8280.0015, subpart 12.

Subp. 2.

Contents.

A global filing must consist of a financing statement describing the requested amendment on a machine-readable file furnished by the submitter and created to the filing officer's specifications containing appropriate indexing information including at a minimum the file number and the information required by Minnesota Statutes, section 336.9-502, subsection (a)(1) and (2). A copy of global filing specifications is available from the filing officer.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0390 ARCHIVES; GENERAL.

Subpart 1.

Scanning.

Paper financing statements must be scanned into the UCC information management system on receipt.

Subp. 3.

Replication and storage.

The data in the UCC information management system must be replicated and stored in appropriate media on a periodic basis.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0400 ARCHIVES; DATA RETENTION.

Data in the UCC information management system relating to financing statements that have lapsed or have been terminated are retained for at least five years from the date of lapse or termination.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0410 NOTICE OF BANKRUPTCY.

The filing officer shall take no action upon receipt of a notification, formal or informal, of a bankruptcy proceeding involving a debtor named in the UCC information management system. Financing statements lapse in the UCC information management system as scheduled unless properly continued.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

INFORMATION REQUESTS AND REPORTS

8280.0420 GENERAL REQUIREMENTS.

The filing officer shall maintain for public inspection a searchable index for all records of financing statements that provides for the retrieval of a record by the name of the debtor and by the file number of the financing statement to which the record relates.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0430 INFORMATION REQUESTS.

Subpart 1.

Contents.

Information requests must contain the information in items A to C:

A.

An information request must state the full correct name of the debtor or other name to be searched and must specify whether the debtor is an individual or an organization. The full name of an individual consists of a first, middle, and last name, followed by any suffix that may apply to the name. The full name of an organization consists of the name of the organization as stated on the articles of incorporation or other organic documents in the state or country of organization or another name to be searched. An information request must be processed using the name in the exact form it is submitted.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0440 RULES APPLIED TO INFORMATION REQUESTS.

Information request responses are created by applying standardized search logic to the name presented to the filing officer by the filer or submitter. Human judgment does not play a role in determining the response to the information request. Items A to I govern responses to information requests.

A.

There is no limit to the number of matches that may be returned in response to the information request.

C.

Punctuation marks and accents are disregarded. Only the letters A to Z in upper or lower case, and numbers 0, 1, 2, 3, 4, 5, 6, 7, 8, and 9, in any combination are considered in responding to the request.

D.

Words and abbreviations at the end of a name that indicate the existence or nature of an organization are disregarded, including, but not limited to: agency, association, assn., associates, assc., assoc., attorney at law, bank, national bank, business trust, charter, chartered, company, co, corporation, corp, credit union, CU, Federal savings bank, FSB, general partnership, gen part, GP, incorporated, inc, limited, ltd, ltee, limited liability company, LC, LLC, limited liability partnership, LLP limited partnership, LP, medical doctors professional association, MDPA, medical doctors professional corporation, MDPC, national association, NA, partners, partnership, professional association, prof assn, PA, professional corporation, prof corp, PC, professional limited liability company, professional limited liability co, PLLC, railroad, RR, real estate investment trust, REIT, registered limited liability partnership, RLLP, savings association SA, service corporation, SC, sole proprietorship, SP, SPA, trust, trustee, as trustee, or abbreviations of the foregoing.

G.

For first and middle names of individuals, initials are equated with all names that begin with the initials, and no middle name or initial is equated with all middle names and initials.

H.

After following items A to G, to modify the name of the debtor requested to be searched and to modify the names of debtors contained in unlapsed financing statements in the UCC information management system, the search will reveal only names of active debtors that, as modified, exactly match the name requested, as modified.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0450 INFORMATION REQUEST RESPONSES.

Information request responses using the logic in part 8280.0440 must include the following:

C.

restatement of the name searched and any limitations requested under part 8280.0460 by the filer or submitter of the information request;

E.

identification of each initial financing statement filed on or before the through date corresponding to the search criteria, by name of debtor, by identification number, and by file date and file time;

F.

history of initial financing statement; for each initial financing statement on the response, a listing of all related financing statements recorded by the filing officer on or before the through date; and

G.

copies of all financing statements revealed by the search unless the filer or submitter of the information request specifically indicates in the request that copies are not to be provided in the response.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0460 OPTIONAL INFORMATION.

Subpart 1.

Limited requests.

A UCC information request may limit the copies produced by reference to the city of the debtor or the date of filing of the financing statements. A request that the search be limited requires that the report created by the filing officer in response to such a request contain the following statement:

"An information request limited under part 8280.0460 has no legal force and effect and may not reveal all filings against the debtor searched. The searcher bears the risk of relying on the limited search."

Subp. 2.

Delivery instructions.

A UCC information request may contain instructions on the mode of delivery requested, if other than by ordinary mail, which request will be honored if the requested mode is then made available by the filing office. The person making the request shall pay all fees associated with the delivery method.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

November 14, 2003

8280.0470

[Repealed, L 2009 c 98 s 36]

Published Electronically:

June 2, 2009

FEES

8280.0480 FEES.

Fees for financing statements delivered by telecopier delivery, electronic mail, or web page entry must be paid for through payment modes arranged for with the Secretary of State by prior agreement or by the use of major credit cards accepted by the Secretary of State. That portion of these fees paid to private vendors for the administration of credit card services will be retained by the Secretary of State for that purpose pursuant to Laws 2000, chapter 419.

Statutory Authority:

L 2000 c 399 art 1 s 139

History:

26 SR 5

Published Electronically:

September 10, 2018

Official Publication of the State of Minnesota

Revisor of Statutes